Canada’s major grocery chains continue to see their sales and profits rise in the midst of record-high inflation, but a new report says it’s hard to determine if they are taking advantage of the situation by profiteering.

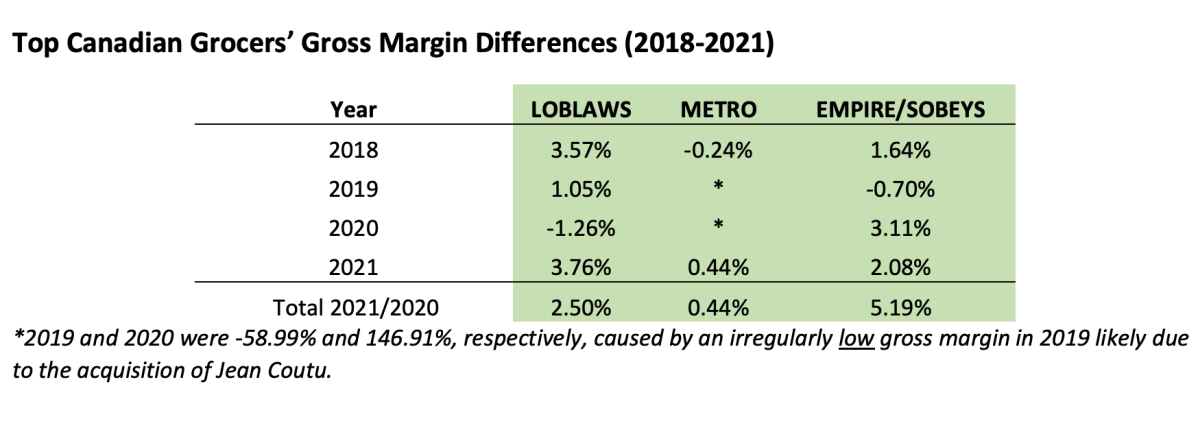

The report from Dalhousie University’s Agri-Food Analytics Lab, released Thursday, compared the year-end profit margins of the three major chains — Loblaw, Metro, and Empire Co., which owns Sobeys — over the past four years and found they stayed “relatively consistent,” leaving little public evidence of so-called “greedflation.”

“Indeed, revenues have increased dramatically, but so have the costs of goods sold,” said the report, which was based off research led by Dalhousie University professor of food distribution and policy, Sylvain Charlebois.

For example, while Loblaw’s gross profit margin was 3.76 per cent by the end of 2021, that’s only up slightly from the 3.57 per cent margin posted in 2018.

Similarly, Empire’s margin also grew less than one basis point over the same time period, from 1.64 per cent to 2.08 per cent. Metro, which actually saw a negative margin of -0.24 per cent in 2018, posted a 0.44 per cent profit margin last year.

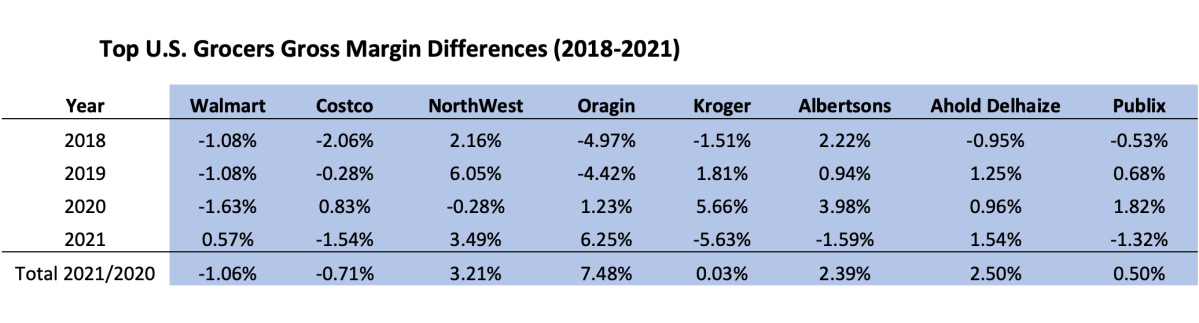

Charlebois and his fellow researchers found that, with a couple of exceptions, the same trend was seen over the past four years among the major U.S. grocery companies, which include Walmart, Costco and Kroger.

“It may look counterintuitive, but the numbers are not pointing to commercial abuse towards consumers,” the report says.

Revenues still rising

The report comes shortly after Statistics Canada reported inflation caused food costs to rise 9.9 per cent this past July, compared with a year ago, the fastest pace since August 1981.

That was despite slowing of the overall inflation rate in July to 7.6 per cent, down from 8.1 per cent in June.

Among food items that have got considerably more expensive, bakery goods are up 13.6 per cent since last year amid higher input costs such as the Russian invasion of Ukraine, which continues to put upward pressure on wheat prices. The prices of other food products also rose faster, including eggs, which are up 15.8 per cent, and fresh fruit, up 11.7 per cent since last year.

The soaring prices are having an impact on shopping habits, with a recent survey finding more than two-thirds of Canadians attributing their financial stress to sticker shock at the grocery store.

In their latest earnings calls over the past two months, the heads of Loblaw, Metro and Empire have lamented that rising food costs have shifted buying habits, with customers sticking to shopping lists and avoiding impulse buys while gravitating toward lower-cost “house” brands. They also said other economic factors like labour shortages have “softened” growth.

Yet all three companies have seen their sales — and profits — continue to increase, according to their latest quarterly earnings reports.

Loblaw’s revenues in its second quarter were $12.85 billion, an increase of $356 million or 2.9 per cent compared with $12.49 billion in the prior year quarter. Adjusted profits for the three months ending June 18 was $566 million or $1.69 per diluted share, up from $464 million or $1.35 per diluted share in the second quarter of 2021.

Metro’s third-quarter results showed a profit of $275 million, up from $252.4 million a year earlier, as sales gained 2.5 per cent. The profit amounted to $1.14 per diluted share for the period ending July 2, up from $1.03 cents per diluted share a year earlier. Sales totalled $5.87 billion, up from $5.72 billion.

Meanwhile, Empire reported a quarterly profit of $178.5 million, up from $171.9 million a year earlier, as its sales also climbed higher. The company said its fourth-quarter profit amounted to 68 cents per diluted share, up from 64 cents per diluted share a year before. Sales in the 14-week period ending May 7 totalled $7.84 billion, up from $6.92 billion.

All three companies, however, said the continued increases were largely due to high sales in the pharmacy divisions, which have far outstripped food sales.

Among Loblaw’s existing stores, for example, pharmacy sales increased 5.6 per cent compared to last year, while food sales rose just 0.9 per cent. Metro, too, saw a 7.2 per cent spike in pharmacy sales compared to a 1.1 per cent rise in food sales.

“Right now cough and cold (sales) … it’s like we’re in the middle of winter,” Loblaw chief financial officer Richard Dufresne said during an earnings call with investors in July.

More evidence needed

The Dalhousie University report suggests more evidence is needed to determine if the major grocery corporations are taking advantage of inflation to post higher profits.

“A proper investigation by the Competition Bureau of Canada would shed more light on practices in the industry,” the researchers wrote, including how food processing, transportation and affiliated companies in the food industry impact costs and profit margins.

Because the publicly available data in earnings reports is “inconclusive at best,” the report concludes that there is “little evidence to suggest grocers in Canada and the United States are colluding or taking advantage of the current food inflationary wave the western world is experiencing.”

The Competition Bureau has not said publicly if it is investigating the operations of the grocery industry. The bureau did not answer Global News’ questions on whether it is planning such a probe.

In the meantime, NDP Leader Jagmeet Singh has made the increased profits a key issue for his party, calling on the Liberal government to impose an “excess profits tax” on major grocery chains and oil and gas companies.

In a statement to Global News, a spokesperson for Deputy Prime Minister and Finance Minister Chrystia Freeland’s office said the government remains focused on “building a fairer and more inclusive economy,” which includes ensuring the wealthiest Canadians and businesses pay their fair share in taxes.

— With files from the Canadian Press

Comments